Lead Nurturing Best Practices

Lead nurturing is a vital part of any marketing and sales strategy. It's all about building relationships with potential customers and guiding them...

5 min read

Inbound 281

January 20, 2023 7:15:00 AM EST

![The Best Customer Acquisition Cost (CAC) Calculators [+ How to Improve CAC in 2023]](https://web.inbound281.com/hubfs/2022%20Inbound%20281%20Website/2023%20Blog/Calculator%20Category%20Page.png)

Are you looking for the best way to calculate your customer acquisition costs (CAC)? If so, you’ve come to the right place! Our inbound specialists have been researching a variety of CAC calculators to provide you with the best calculator on the market today. We will walk you through the importance of understanding your CAC, how to calculate your CAC, important CAC benchmarks you need to know, and even how to start improving your CAC in 2023.

Let’s begin with the basics. What Is a CAC Calculator? A customer acquisition cost (CAC) calculator is a helpful tool that helps you discover the best approximation of your total cost of acquiring a new customer. A company can use the results to discover further insights into various aspects of its marketing campaign as well as help a company establish a better-aligned marketing budget. Many companies don’t realize how many expenses are associated with obtaining a new customer. Costs such as advertising, customer retention, or customer service can add up quickly.

Understanding a company’s customer acquisition costs can help companies measure their return on investment for various acquisition campaigns, channels, and products. Calculating CAC can help companies visualize where their acquisition budget is being spent, so they can better decide how much money they should be investing into their customer acquisition efforts. Companies can then evaluate which marketing campaigns and strategies they should continue to invest in, and which ones to discontinue.

Now that you have a better understanding of why you need to be calculating your customer acquisition costs, let’s look at some of the best (and some of our favorite) free online CAC calculators that are available to you.

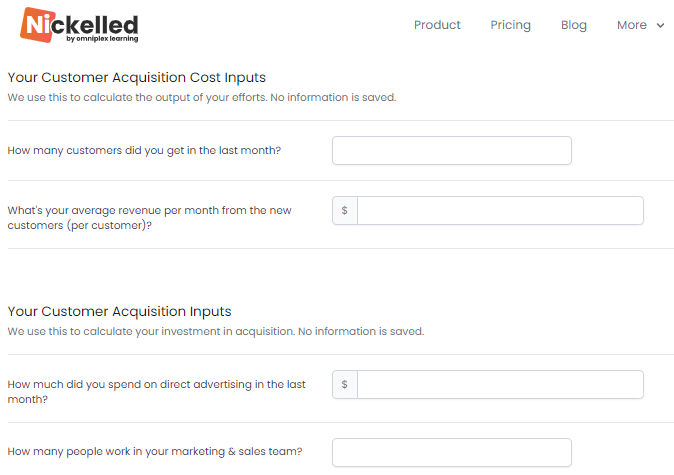

The Nickelled CAC calculator offers a more detailed look into your customer acquisition costs. Rather than just calculating your CAC based on general spending and the number of customers, the Nickelled CAC calculator factors in investment inputs including software, advertising, and team expenses.

The Nickelled CAC calculator will also provide you with an estimated CAC payback period depending on your average CAC.

Source: https://www.nickelled.com/

Source: https://www.nickelled.com/

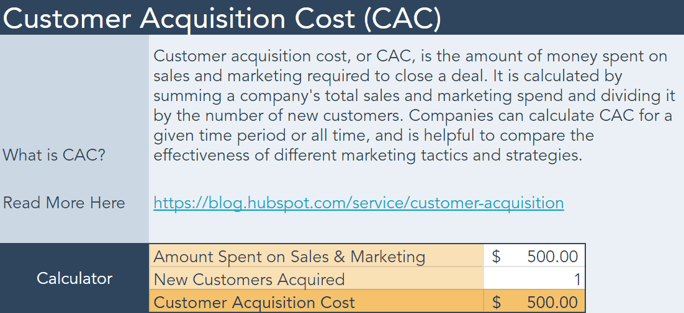

HubSpot’s CAC calculator is included as part of their Customer Service Metrics Calculator. Created in an excel template, you will get access to the CAC calculator, as well as numerous other key performance metric calculators including customer lifetime value (CLV), customer acquisition cost to customer lifetime value (CAC-CLV), customer retention rate, and more.

Source: https://www.hubspot.com/

Source: https://www.hubspot.com/

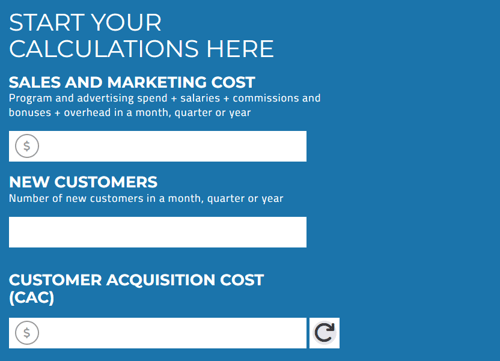

At Inbound 281, our CAC calculator estimates the total value of each customer compared to what you spend to acquire them.

We also recommend our marketing % of customer acquisition cost calculator that narrows in on the marketing percentage of customer acquisition costs. You can calculate the marketing portion of your CAC calculated as a percentage of the overall CAC. This can show you how your marketing team’s performance and spending impact your overall customer acquisition cost.

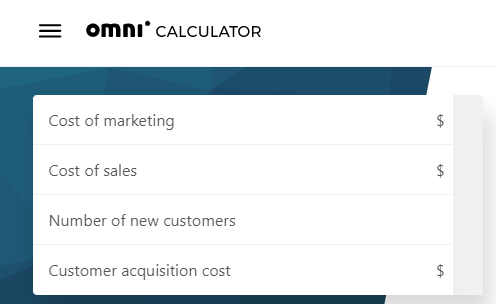

Omni CAC calculator provides you with a digital calculator as well as step-by-step instructions on how to calculate your customer acquisition costs. In addition to a simplified CAC calculator, Omni Calculator provides you with CAC examples to help you better understand the concept.

Source: https://www.omnicalculator.com

Source: https://www.omnicalculator.com

After calculating CAC, a major challenge businesses are facing is understanding how their CAC fits into industry benchmarks. Which channels are my competitors in the industry investing in? Does my CAC align with the average CAC in my industry? What are my marketing department's strengths and weaknesses? These questions can be answered by better understanding customer acquisition cost benchmarks for your industry.

The following charts will share insight into reasonable CAC estimates for individual industries. Research from First Page Sage features data from B2B and B2C clients between 2018 and 2023.

Below are the average CACs in B2B industries.

|

Industry (B2B) |

Average CAC (Organic) |

Average CAC (Inorganic) |

|

Automotive |

$526 |

$918 |

|

Aviation |

$588 |

$967 |

|

B2B Saas |

$205 |

$341 |

|

Business Consulting |

$410 |

$901 |

|

Engineering |

$459 |

$672 |

|

Higher Education & College |

$862 |

$1985 |

|

IT & Managed Services |

$325 |

$840 |

|

Manufacturing |

$662 |

$905 |

|

Real Estate |

$660 |

$1185 |

|

Software Development |

$680 |

$841 |

Below are the average CACs in B2C industries.

|

Industry (B2C) |

Average CAC (Organic) |

Average CAC (Inorganic) |

|

Automotive |

$178 |

$234 |

|

Aviation |

$475 |

$708 |

|

Higher Education & College |

$134 |

$177 |

|

Real Estate |

$103 |

$226 |

|

Saas |

$135 |

$197 |

Every business can benefit from lowering its expenses, so why not start with lowering your customer acquisition costs? To improve your CAC, you need to focus on lowering your expenses within your acquisition process. Look at various expenditures and resources used to acquire and onboard new customers, and evaluate what you can do better to increase the efficiency of these operations. Here are some of the core methods we suggest you focus on to start improving your CAC.

One of the most effective ways to decrease your CAC is to define your target customer. When you narrow your focus on a specific type of customer, you can save money by not wasting time and resources on customer acquisition strategies that are not likely to be successful.

What does your ideal customer look like? What is their career, hobbies, or favorite activities? What challenges are they looking to solve? Creating a buyer persona can help you in various aspects of your business, including improving your CAC. Once you have identified who your target customers are, you can focus your marketing efforts on a more targeted group that is most likely to indulge in a sale.

Once you have defined your target customer, take the time to re-evaluate your advertising strategies. How are you currently advertising to potential customers? Are you advertising to your target audience? Are you creating ads that are specifically designed to appeal to them? Utilize different targeting strategies to ensure that your advertisements are being shown to viewers who are likely to be interested in them.

To better connect with your target audience, create ads that are tailored to your audience's preferences. This means creating ads that are more targeted and relevant to your ideal customers, and in turn, ads that are more effective at driving conversions. This way, you can lower your CAC while actually improving results.

Acquiring new customers can be done through many channels, but not all channels may be the most suitable for your strategy. Companies often feel the need to focus on too many, or all channels that are available to them resulting in an increase in expenses, time, and resources for channels that are unlikely to produce their desired results.

To help reduce customer acquisition costs, focus your customer acquisition strategies on the channels that are most likely to yield results. Take the time to research what channels will work best for your goals before diving into your campaign. Several customer acquisition techniques such as content marketing, social media, email marketing, or even paid advertising have proven to be some of the best techniques for customer acquisition.

But that doesn’t necessarily mean that these will be the best channels for you. When experimenting with what channels are working best for your campaign, be sure to keep track of the results so you can fine-tune your customer acquisition strategies, and ultimately improve your ROI and lower your CAC.

A great way to reduce customer acquisition costs is to improve your customer retention. Acquiring new customers can be a costly endeavor, and it’s important to make sure your new customers (and your current customers) will be loyal customers now and in the future.

The more happy customers you can retain, the less money you will have to invest in CAC. Some effective methods to increase customer retention are to build trust with your customers, provide personalized customer experiences, or even offer a customer loyalty program.

As HubSpot stated, “What’s better than acquiring one new customer”? And the answer was not acquiring two new customers, it was retaining an existing customer. Maintaining a current customer costs 5-25x less than acquiring a new customer -- which sounds like a great way to lower your customer acquisition costs.

Every business wants to grow its customer base, but an unmanaged CAC can quickly eat away at a company’s profits. Understanding your customer acquisition costs can help you create an insightful strategy for business growth in 2023.

All of the CAC calculators that we mentioned in this article can serve as a great starting place for you to revamp your customer acquisition strategy and make more informed decisions when it comes to improving your CAC. With the right tools and the right strategy, you can reduce your customer acquisition costs AND acquire new customers at the same time.

Lead nurturing is a vital part of any marketing and sales strategy. It's all about building relationships with potential customers and guiding them...

Do you know the Customer Acquisition Cost (CAC) for each of your Inbound Marketing Solutions? How about the Time to payback CAC? In order for your...

.png)

As a marketing manager or specialist, you may find yourself in need of a B2B Marketing Consultant to elevate your business's marketing efforts. By...